10.96. Kirby Monetary Choice Questionnaire (MCQ)¶

Series of hypothetical choices pitting an immediate amount of money against a delayed amount of money, to measure delay discounting.

10.96.1. History¶

Kirby et al. (1999) [27-item version].

Based on the earlier 21-item version: Kirby & Maraković (1996).

10.96.2. Source¶

From Kirby et al. (1999) as above.

10.96.3. Calculations¶

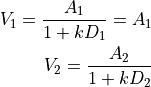

Hyperbolic delay discounting. The principle is to judge the value  of two options,

of two options,  and

and  . Each has an amount

. Each has an amount  ,

,

and a delay

and a delay  ,

,  . Hyperbolic delay discounting

is assumed, according to the discounting parameter

. Hyperbolic delay discounting

is assumed, according to the discounting parameter  :

:

In the case of the Kirby MCQ, one option has zero delay (the small immediate

reward or SIR – call it option 1):  . One has a delay (the large

delayed reward or LDR – call it option 2).

. One has a delay (the large

delayed reward or LDR – call it option 2).

The values are therefore:

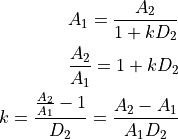

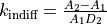

At indifference:

so at indifference:

Given a set of trials, a subject’s indifference point  can be

calculated in various ways.

can be

calculated in various ways.

Kirby’s method (Kirby et al. 1999; Kirby, 2000). For each question, at

indifference,  can be calculated from the equations

above via

can be calculated from the equations

above via  . Kirby’s method

compares subject’s choices against these indifference

. Kirby’s method

compares subject’s choices against these indifference  values: if the

subject chooses the delayed option, then

values: if the

subject chooses the delayed option, then  , and if

the subject chooses the immediate option, then

, and if

the subject chooses the immediate option, then  .

For a consistent series of choices, the geometric mean of the tested

.

For a consistent series of choices, the geometric mean of the tested  values straddling the subject’s indifference point is taken as the subject’s

values straddling the subject’s indifference point is taken as the subject’s

value. If the subject’s

value. If the subject’s  value falls outside the tested

range (i.e. all choices were for the immediate, or all for the delayed,

option), then the most extreme assessed

value falls outside the tested

range (i.e. all choices were for the immediate, or all for the delayed,

option), then the most extreme assessed  is used. Where choices are

not consistent, then the subject’s value of

is used. Where choices are

not consistent, then the subject’s value of  is taken as the

is taken as the  value with which the subject’s choices were most consistent (i.e. the most

choices were as predicted by that value of

value with which the subject’s choices were most consistent (i.e. the most

choices were as predicted by that value of  ) or, if there is no clear

winner, the geometric mean of multiple possible tested

) or, if there is no clear

winner, the geometric mean of multiple possible tested  values that

were equally and maximally consistent with the subject’s choice. This geometric

mean approach reduces to the simple ‘consistent’ approach for consistent

choices, and thus may be used throughout.

values that

were equally and maximally consistent with the subject’s choice. This geometric

mean approach reduces to the simple ‘consistent’ approach for consistent

choices, and thus may be used throughout.

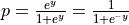

Wileyto et al.’s method (Wileyto et al., 2004). This method defines the

reward ratio  , and then predicts the probability

, and then predicts the probability

of choosing the delayed response using a logistic regression,

of choosing the delayed response using a logistic regression,

where

where  . That is,

. That is,  and

and  are used as predictors, obtaining the coefficients

are used as predictors, obtaining the coefficients

and

and  . At indifference, where

. At indifference, where  , this

gives

, this

gives  , and hence

, and hence  is estimated by

is estimated by  . However, it is possible for

such estimates to be negative under conditions of inconsistent choice.

. However, it is possible for

such estimates to be negative under conditions of inconsistent choice.

Todo

Reference RNC new method when published.

is the delay at which a prospective reward has decayed to

half its original value.

is the delay at which a prospective reward has decayed to

half its original value.

10.96.4. Intellectual property rights¶

Believed to contain no significant intellectual property, aside from the code, which is part of CamCOPS.

10.96.5. References¶

Kirby KN, Petry NM, Bickel WK (1999). Heroin addicts have higher discount rates for delayed rewards than non-drug-using controls. Journal of Experimental Psychology: General 128: 78-87. https://www.ncbi.nlm.nih.gov/pubmed/10100392

Kirby KN, Maraković NN (1996). Delay-discounting probabilistic rewards: Rates decrease as amounts increase. Psychon. Bull. Rev. 3: 100-104. https://www.ncbi.nlm.nih.gov/pubmed/24214810; https://doi.org/10.3758/BF03210748.

Kirby KN (2000) Instructions for inferring discount rates from choices between immediate and delayed rewards. Unpublished, Williams College.

Wileyto EP, Audrain-McGovern J, Epstein LH, Lerman C (2004). Using logistic regression to estimate delay-discounting functions. Behav Res Methods Instrum Comput J Psychon Soc Inc 36: 41–51. https://www.ncbi.nlm.nih.gov/pubmed/15190698.